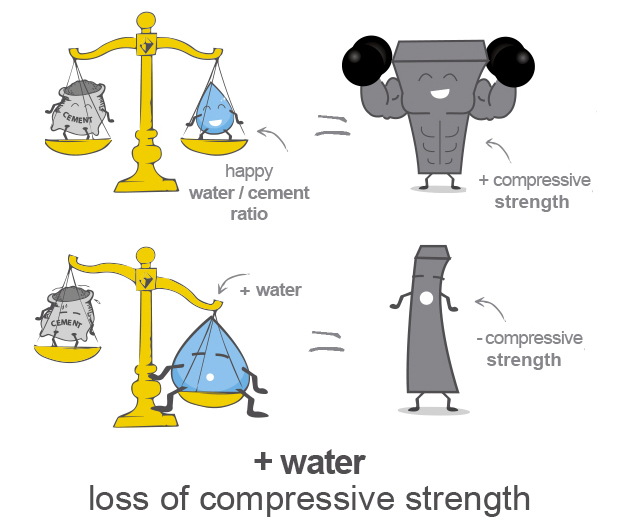

Importance of Water Cement (W/C) Ratio

- The W/C ratio significantly impacts concrete durability.

- Normal cement pastes tend to form large aggregates called ‘floes’ due to attractive forces between cement particles when they come into close contact.

- This aggregation leads to excess water being added, increasing the W/C ratio and negatively affecting concrete properties.

Overcoming W/C Ratio Issues:

- Superplasticizers, when added at the right stage during concrete mixing, can mitigate these issues effectively.

Superplasticizers in Concrete:

- Superplasticizers are vital water-reducing additives in concrete production.

- They enable the creation of high-strength concrete with normal workability while maintaining a low water/cement ratio, thereby reducing heat of hydration.

- Their function includes reducing inter-particle attraction among cement particles and dispersing them using less water.

- Examples of superplasticizers include sulphonated melamine formaldehyde condensates or sulphonated naphthalene formaldehyde condensates.

An inheritance tax will help reduce inequality

Importance of Addressing Inequality:

- Inequality negatively impacts long-term growth by hindering firm productivity, reducing labor income, and diverting resources away from essential areas like education.

- In unequal societies, one’s place of birth disproportionately influences lifetime outcomes, with nearly a third of consumption variation in India linked to regional disparities.

- High inequality fosters political polarization, increased conflict, and diminished earnings for the poor, leading to reduced consumption and savings, thus hampering economic growth.

Inheritance Tax as a Solution:

- Implementing an inheritance tax could effectively reduce wealth concentration and encourage investment in productive ventures.

- Well-designed inheritance taxes, applied to individuals with significant wealth above a defined threshold, can help redistribute wealth and finance innovative initiatives.

- Countries like Japan have successfully employed high inheritance taxes, demonstrating its potential efficacy.

Land Value Tax (LVT):

- Another approach is the LVT, which taxes the rental value of land irrespective of the property built on it.

- Unlike labor, land is a natural resource and remains unaffected by tax changes, making LVT efficient and fair.

Challenges and Solutions:

- Critics argue that tax evasion among the wealthy undermines the practicality of these taxes.

- However, economists suggest that modest wealth and inheritance taxes, particularly on the top 1%, could significantly boost public expenditure, enabling the provision of essential socio-economic rights such as living wages, healthcare, employment, and food security.

Kotak Mahindra Bank (KMB) Controversy

Background:

- The Reserve Bank of India (RBI) imposed restrictions on KMB, prohibiting it from onboarding new customers through online and mobile banking channels and issuing fresh credit cards. Existing customers, however, can still avail these services.

- The RBI attributed these actions to deficiencies observed in KMB’s IT systems and controls, which were deemed inadequate considering the bank’s growth trajectory.

Basis of RBI’s Actions:

- The RBI identified significant deficiencies and non-compliances in various areas of KMB’s IT operations, including IT inventory management, user access control, data leak prevention, business continuity, and disaster recovery.

- These observations were made over a two-year examination period (2022-2023), during which KMB allegedly failed to address concerns promptly and comprehensively.

- Additionally, the bank was found to be non-compliant with RBI’s recommended Corrective Action Plans (CAPs), which are intended to strengthen regulatory compliance and operational robustness.

Impact on Bank’s Financials:

- S&P Global Ratings suggests that the regulatory intervention could hamper KMB’s credit growth and profitability, particularly affecting its credit card segment, which has been a key area of growth for the bank.

- KMB’s credit card portfolio witnessed significant year-on-year growth (52%) compared to the overall loan growth (19%), with a significant portion of personal loans and fresh credit cards being sold digitally.

- With restrictions on digital customer acquisition, the bank may need to rely more on physical branch expansion to drive growth, potentially leading to higher operating costs.

This controversy underscores the importance of robust IT infrastructure and compliance mechanisms for financial institutions to ensure regulatory compliance and sustainable growth.

U.K. deporting migrants to Rwanda

Background

- British authorities recently deported an asylum seeker to Rwanda as part of a voluntary returns scheme and initiated the detention of other migrants in the country.

- In April 2022, the U.K. and Rwanda struck a deal to address issues related to undocumented migration, although the relocation policy was later deemed unlawful by the U.K. Supreme Court.

Facilitation of Deportation:

- The deportation was facilitated through the Voluntary Returns Scheme (VRS), a longstanding program introduced by the Home Office in 1999 and co-funded by the European Refugee Fund.

- Under this scheme, the British government offers financial assistance to migrants and failed asylum seekers who choose to depart to a safe third country.

Safety Concerns in Rwanda:

- Despite being densely populated, Rwanda remains among the least developed nations globally.

- Human rights organizations have criticized Rwanda for suppressing dissent, controlling media and opposition, and allegedly supporting rebel groups in neighboring countries.

- The majority of refugees in Rwanda are highly vulnerable and reliant on humanitarian aid, with around 90% living in camps.

Motivation for Rwanda’s Involvement:

- As part of the asylum plan, the U.K. government will provide development funding to Rwanda and cover processing and integration costs for relocated individuals.

- The U.K. has already paid Rwanda £220 million, with an estimated total cost of £600 million for resettling 300 refugees.

- Rwandan President Paul Kagame denies that the country’s participation in the U.K.’s asylum plan is economically motivated or involves trading people.

Despite promises of financial support from the U.K., concerns persist regarding the safety and well-being of migrants deported to Rwanda, especially given the country’s human rights record and the vulnerability of its refugee population.

India opens up investment options for Russia to channel rupee balance

Efforts by the Reserve Bank of India (RBI) and regulatory amendments have alleviated Russia’s payment difficulties with India.

Vostro Accounts:

- India and Russia established a rupee payment system to navigate economic sanctions imposed by the West following Russia’s actions in Ukraine in February 2022.

- Concerns arose over Russia’s growing unused rupee balance, prompting attempts to repatriate it by converting it into dirhams or yuan.

- However, India is now actively investing the rupee balance within the country, identifying projects for Russian investment.

Investment Opportunities:

- Recent amendments to FEMA regulations have simplified trading in derivatives for foreign investors.

- Russia is permitted to invest in Indian equity and debt markets, and it has expressed significant interest in doing so.

- Russia has emerged as India’s second-largest import source, trailing only China, overtaking the UAE and the U.S.

- India’s imports from Russia surged by 32.95% to $61.44 billion in 2023-24, resulting in a trade deficit of $57.18 billion.

- Main imports from Russia include oil, defense equipment, fertilizers, edible fats and oils, as well as precious and semi-precious stones and jewelry.

These developments signify a significant shift in India-Russia economic relations, with India actively facilitating investment opportunities for Russia within its borders, thereby addressing Russia’s payment concerns and strengthening bilateral trade ties.