A visit to preserve China’s interests in Europe

Context

Chinese President Xi Jinping embarked on his first trip to Europe (excluding Russia) in five years, visiting France, Serbia, and Hungary earlier this month.

World Events and Visit’s Goals

- The COVID-19 pandemic led China to recalibrate its global investment objectives due to international travel restrictions.

- Geopolitical dynamics shifted significantly with the Russian invasion of Ukraine and the transformation of the China-U.S. trade conflict into a technology dispute.

- Accusations of Chinese dumping of inexpensive goods intensified in the U.S. and Europe, prompting calls for countermeasures.

Visit Objectives

- Xi Jinping aimed to prevent the European Union from aligning too closely with the United States, avoid a trade standoff with the EU, and enhance China’s influence in Europe.

- The visit indirectly influenced negative perceptions within the EU regarding China’s trade policies.

- France shares the EU’s concerns about the competitive advantage of Chinese electric vehicles (EVs) over European automobiles, prompting discussions during Xi’s meeting there.

- While China seeks to capitalize on its EV industry, Europe is committed to safeguarding its car manufacturers.

Focus on Hungary

- Hungary is China’s most significant ally within the EU, offering access to the largest trading bloc globally.

- Chinese foreign direct investment in Serbia is increasing, with substantial investments in copper mining and steel processing, totaling $5.5 billion.

- Notably, China is upgrading the Belgrade-Budapest high-speed railway project and has plans for additional infrastructure development with Hungarian investments.

- Proposed railway connections aim to link Chinese factories in eastern Hungary with markets in western Europe.

Dynamics Between Eastern and Western Europe

- China previously fostered relations with Eastern European nations through the 17+1 China and Eastern Europe (CEE) framework, but tensions arising from the Ukraine conflict strained these ties.

- Xi’s visit is defensive in nature, aiming to safeguard Chinese interests in Europe amidst challenging geopolitical circumstances.

- However, visits to Hungary and Serbia may not significantly improve relations with the broader European community, which increasingly views China with skepticism.

Should doctors be kept out of the Consumer Protection Act?

Summary of Recent Developments:

Supreme Court ruling on liability under Consumer Protection Act:

- Advocates exempt from liability for deficiency in service.

- Hinted at revisiting 1995 decision on medical professionals’ liability.

Implications for Consumer Protection Act on Doctors:

- Context of Consumer Protection Act’s aim to safeguard consumer rights.

- Indian Medical Association v. V.P. Shantha landmark case’s significance.

- Misuse of Act by some, leading to challenges.

- Limitations of Indian Medical Council Act in aiding affected patients.

Challenges Arising:

- Lengthy legal process: district forum to National Consumer Disputes Redressal Commission.

- Ten-year timeframe to prove innocence.

- Favorable remedies for patients under the Act, but delay and frivolous litigation concerns.

- Most cases involve genuine malpractice or strongly perceived wrongs.

Proposed Solutions:

- Need for robust regulatory body overseeing medical professionals.

- Importance of medical indemnity insurance.

- Practices ensuring diligent service delivery and proper record-keeping.

- Adherence to checklist protocols and clear communication to mitigate litigation risks.

- Distinction between action against malpractice and compensation for aggrieved consumers.

- Proposal for an independent authority akin to ombudsman for insurance and banking sectors.

Rising debt strains household savings

Change in Savings Composition:

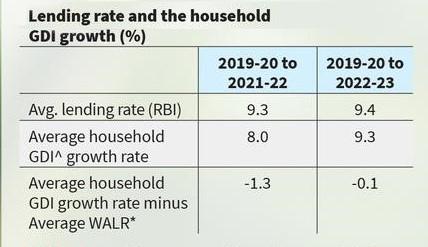

The recent debate focuses on the significant drop in household net financial savings to GDP ratio in 2022-23 due to increased borrowing to GDP ratio.

Not just a shift in savings pattern:

- Household savings to GDP ratio consists of net financial savings, physical savings, and gold ornaments.

- While net financial savings to GDP ratio fell by 2.5 percentage points, physical savings increased by only 0.3 percentage points.

- The rise in household borrowing to GDP ratio by 2 percentage points exceeded the increase in physical savings to GDP ratio.

- Gold savings to GDP ratio remained largely unchanged, resulting in a 1.7 percentage point decline in household savings to GDP ratio.

Indicators of Structural Change:

- Interest payment in household income depends on interest rate and debt-income ratio.

- Two factors influence the debt-income ratio:

- Higher net borrowing-income ratio, calculated as total borrowing minus interest payments.

- Exogenous factors like interest rate on outstanding debt and nominal income growth rate.

- Described as Fisher dynamics, inspired by Irving Fisher, illustrating the rise in debt-income ratio due to changes in interest rate and nominal income growth rate.

Macroeconomic Challenges:

- Despite India’s debt servicing ratio being lower than many countries, Fisher dynamics pose unique challenges.

- First challenge: Closing the gap between interest rate and income growth, and slowing down the growth of household debt-income ratio.

- Second challenge: Risk of reducing aggregate demand amid high interest payments and household debt commitments.

- Addressing these challenges highlights the necessity of including an additional macroeconomic policy target to boost and sustain household income growth.